Heat stress monitors are being increasingly deployed in manufacturing facilities to track the health of workers being exposed to heated conditions. To ensure the health of workers, ministries/departments of labor of the U.S., Saudi Arabia, the U.K., India, Germany, Japan, Australia, and South Korea have set stringent guidelines regarding heat stress management at workplaces. For instance, the OSHA has set workplace safety standards and drafted workplace monitoring regulations to protect employees from being exposed to hazardous environments.

Get the Sample Copy of this Report at: https://www.psmarketresearch.com/market-analysis/heat-stress-monitor-market-report/report-sample

In recent years, technological advancements in the domain of heat stress monitoring have led to the development of wearable monitoring equipment. For instance, Qatar Mobility Innovations Center (QMIC) offers innovative smart heat stress monitoring solutions to support occupational health and safety management efforts. These solutions run on a smart internet of things (IoT) platform and offer automated systems for monitoring the heat stress of workers in real-time.

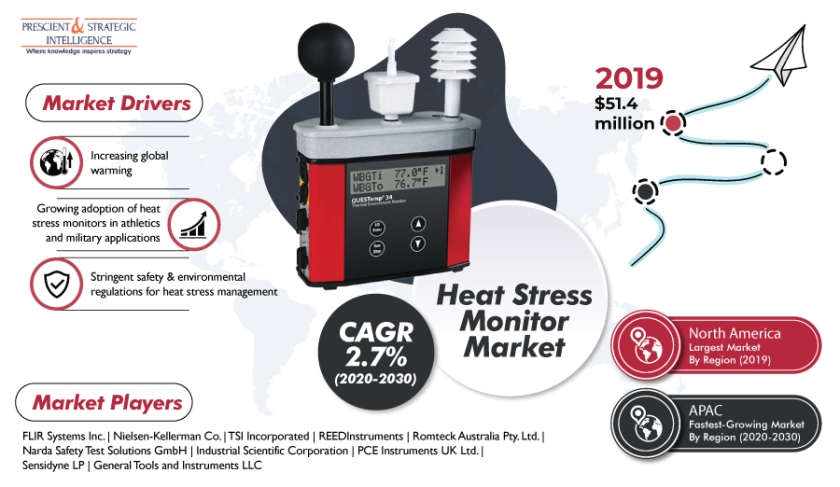

The adoption of these solutions has enabled the protection of the workforce from heat-related ailments. Geographically, North America dominated the heat stress monitor market in the recent past, due to the presence of strong government guidelines regarding the safety of employees being exposed to high temperatures in the region.

For instance, the OSHA and NIOSH mandates the usage of heat stress monitors in the chemical, mining, oil and gas, industrial manufacturing, and petrochemical sectors of the U.S. to monitor the health of employees. Moreover, the upcoming 2026 FIFA World Cup will also fuel the adoption of heat stress monitors in the U.S., Mexico, and Canada.

Thus, the rising need to monitor the health of athletes and military personnel and surging requirement of protecting the health of employees working in adverse working conditions will propel the adoption of heat stress monitoring solutions in the foreseeable future.